C-Suite Executive

Private Equity

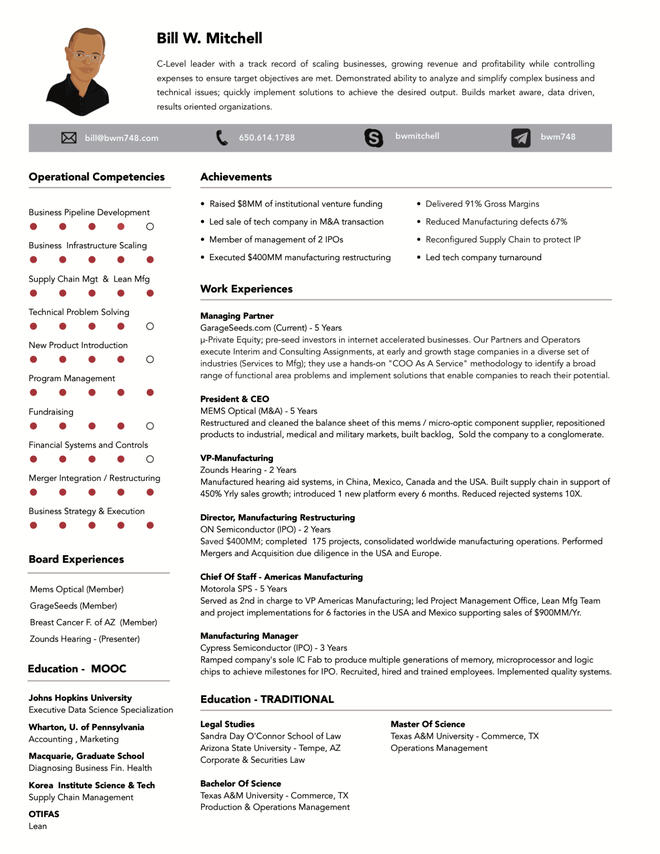

Bill W. Mitchell

C-Suite Executive

Building Strong

Technology Companies

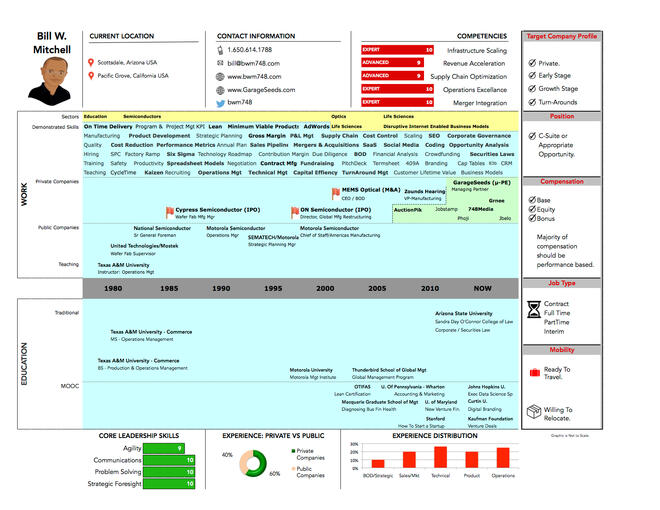

Bill, is a well known and respected senior executive with more than 30 years experience in high technology dealmaking, manufacturing, retailing and leveraging the internet to drive profitable growth.The first half of his career was spent building classic management skills; technology, R&D, manufacturing, supply chain and accounting with the 2nd half devoted to helping companies manage through high change environments, from Venture Capital backed startups like Mems Optical to multi-billion dollar Private Equity funded businesses like ON Semiconductor.

Education

TRADITIONAL EDUCATION

Legal Studies

Sandra Day O'Connor School of Law,

Arizona State University, Tempe, AZ.

Corporate and Securities Law.Master of Science

Texas A&M University - Commerce, Commerce TX.

Operations Management.Bachelors of Science

Texas A&M University - Commerce, Commerce TX.

Production & Operations Management.

MOOC EDUCATION

Executive Data Science Specialization

The John Hopkins UniversityAccounting & Marketing Courses

Wharton School, The University of PennsylvaniaDiagnosing Business Financial Health

Macquarie Graduate School of ManagementSupply Chain Management

Korea Institute of Science and TechnologyLean

OTIFAS

Results

Select Accomplishments

Will be discussed in detail including dollarization depending upon your specific needs.

StrategyManufacturing RestructuringMergers & AcquisitionsSupply Chain OptimizationFundRaising

Raised millions of dollars from professional venture capital investors.Revenue AccelerationProject ManagementLean ImplementationISO ImplementationMarketingCost ControlMerger IntegrationE-CommerceDeliver Profitable GrowthCollaborationCommercial DevelopmentProvide Leadership and Develop TalentLead in Client ManagementBusiness Impact

Skills

COO As A Service

A complete solution for your company.

M&A Merger Integration

Corporate Governance

Supply Chain Optimization

Operations Management

Fund Raising

CashFlow Control

Data Science

AI

Technical

P&L Management

Margins

CashFlow Improvement

Revenue Acceleration

Manufacturing

Project Management

Financial Systems & Controls

Specialized Recruiting

Social Media Campaigns

Leadership

Opportunity Analysis

Data Science

Lean Implementation

Infrastructure Scaling

Strategic

You Get The Results You Expect

Experience

GARAGESEEDS

MANAGING PARTNER

Micro Private Equity Investors and operators. $36MM of assets under management. Purchasers of bootstrapped early-stage businesses, side projects, and startups.

ZOUNDS HEARING

VICE PRESIDENT OF OPERATIONS

A private, venture capital backed manufacturer of hearing aid systems selling direct to customers thru company owned stores.

MEMS OPTICAL

PRESIDENT & CEO

A private, Venture Capital backed of micro-optic and mems components and systems.

ON SEMICONDUCTOR

DIRECTOR, MANUFACTURING RESTRUCTURING

A multi-billion dollar Private Equity purchase of Motorola SPS's discrete semiconductor operations.

MOTOROLA SPS

CHIEF OF STAFF, AMERICAS MANUFACTURING

$1.2B (Revenue) semiconductor manufacturing and assembly factories located across the United States and Mexico

CYPRESS SEMICONDUCTOR

MANUFACTURING MANAGER

A venture capital funded semiconductor manufacturing startup.

Technology and Tech-Enabled

companies contact me when

they have Big Problems or

See Large Opportunities.

In each situation, Jobs and/or

Financials will be impacted

if not resolved quickly.

That's why we offer

"COO As A Service".

COO AS A SERVICE

A Complete Solution

REVENUE

Acceleration

Pipeline Development

Segmentation & Targeting

Customer Lifetime Value

CASHFLOW

Control

Fast, Accurate Closings

Clean Up the Books

Control The BurnRate

MARGINS

Foundation

Cost-Cutting

Product Mgt

New Products

SCALE

Infrastructure

Manufacturing & Operations

Productivity, Lean, Kaizen

Scaling, TroubleshootingSecure Supply Chain

Contract NegotiationsOutSourcing

Sourcing PartnersContract Manufacturing

Asian and North AmericanProject Management

Ontime / OnBudget

PMI Principles

STRATEGIC

The Future

C-Suite Interaction & Support

Business Model Refinement

Performance Management

Mergers & Acquisitions

Merger Integration

FundRaising

Governance

KPI

We Deliver Results

Many Situations Require

Doing More - Faster - With Less

We curate the following

Twitter feeds to stay on

top of Industry trends.

Hand Curated

News Feed

Hire

Bill draws on 20+ years of working with many of the leading technology companies, founders and chief executives; across professions, industries and organizations.The tech world changes quickly; Bill constantly refresh his education, experiences and is always in a learning mode to stay up to date in this fast paced environment.Areas of accomplishment span the full range of business activities. Fundraising, M&A, Contract Manufacturing, Strategy, Operations, New Product Introduction, P&L Optimization, Sales, Marketing, Product-Market Fit & Supply Chain.SECTORS

Technology and Tech-Enabled Companies

Manufacturing • Retail • SaaS • Services

We Deliver Agreed Upon Results: On-Time.

COO "AS A SERVICE"

Not ready for a Full Time COO?Requirements beyond the

capabilities of your staff?Extend The CEOs Reach.

CONSULTING

Most Functional AreasHardware - Software - ServicesStartups to Emerging Growth

C-SUITE: FULL TIME

Apply Fundamentals

To Build Business

PRESS

Available to participate in press interviews.

Bill W. Mitchell

C-Suite Executive

Building Strong Companies

Bill, is a well known and respected senior executive with more than 30 years experience in high technology dealmaking, manufacturing, retailing and leveraging the internet to drive profitable growth.The first half of his career was spent building classic management skills; technology, R&D, manufacturing, supply chain and accounting with the 2nd half devoted to helping companies manage through high change environments, from startups like Mems Optical to multi-billion dollar ON Semiconductor.Texas A&M University Commerce Bachelor and Masters degrees. Attended Arizona State University, Sandra Day O'Connor School of Law. Continual refreshment of finance, operations and technical education.

Musings

Industries

Hearing Aids - The Next Generation 2018

Dockless Electric Scooters 2018

Dockless BikeSharing 2017

Over 150 Mattress In A Box Companies 2018

Robotics As A Service 2017

Technology

IOT Explained Simply - TBD

Machine Learning Explained Simply - TBD

Data Lake Explained Simply 2018

BlockChain Explained Simply 2017

Initial Coin Offerings "ICOs 2017

CryptoCurrency 2014

Tesla Powerwall 2014

Operations

Logistics: Robots & Drones 2017

Supply Chain Performance 2016

Making OKRs Work 2016

Applying Lean 2016

Startup Ecosystem

The GIG Economy 2015

The Problem With Profitless Startups

Terms, Preferences & Control 2017

My Passions

Adventures in Food, Photography & Fun

Machine Learning Explained Simply - 2018

Bill Mitchell

Data Lake Explained Simply - 2018

Bill Mitchell

Last Updated: August 29, 2018An easy way to visualize a data lake is to see it as a large body of water being filled from multiple sources, rivers, streams, rainfall, etc.. the water is in its natural state, from a variety of sources, unfiltered, untreated and with no predefined structure.The lake accepts all types and sources of water. Both structured and unstructured data is stored in the lake. Any data that is put into the lake is retained.A data warehouse is like filling your swimming pool with a water hose connected to your municipal water system. The water is from a consistent source, its been processed and filtered to a consistent format. The data is organized.In a data warehouse only the data that will be used for the case will be retained.An organization may choose to have both a data lake and a data warehouse.

**State of the Electric Scooter Business **

Bill Mitchell

Updated: September 19, 2018Dockless electric scooters "E-Scooters" have blasted their way into the conversation as a legitimate option for convenient, inexpensive, short distance transportation, in urban environments. Bird, Lime and Skip now have more than 60,000 e-scooters on the streets of the United States.Scooter startups are focusing on:- Fundraising, raise money while the sector is hot

- Scaling, get big fast, national, international ahead of the competition

- Partner with ridesharing companies (Uber, Lyft, etc..)

- Inclusion as a ride option on ridesharing companys apps

- Working with cities to develop regulations that do not restrict growth as many cities will limit the number of scooter companies operating within their boundaries

The business model

This business is straightforward,

- Unlike Uber or Lyft the scooter company buys the scooter

- Companies buy generic scooters and customizes them (GPS, security, payment)

- Fully charged scooters in high foot traffic urban areas.

- There is no dock or central charging station

- A customer either sees or uses the app to locate an unused scooter, thenuses the company's app to activate the scooter ($1) and pay for the ride ($0.15/Minute).

- At the end of the ride the customer leaves the scooter in place

- Each night a "charger" locates the scooter via gps, charges it and returns it to the scooter company. It takes 4 to 8 hours to recharge the scooter

- The scooter company redistributes them around the city at the start of the new day. And the cycle repeats.

Supply Chain

Segway-Ninebot, based in Beijing, China is the dominant supplier of e-scooters; manufacturing over 200,000 per month; they sell to most rental companies and directly to the public.Some rental companies (Bird) are testing Electisan scooters, which are reported to be more durable.Companies typically pay $300 - $400 per scooter (before tariffs).Multiple companies are considering ordering components, opening their own factories, and assembling scooters in the USA as a way around the 25% tariff on Chinese scooter imports and to be in control of their supply chain.Bird signed an exclusive agreement to manufacturer a rugged version of Electisan scooters.New Scooter Manufacturers: Minimotors (South Korea), Electisan (China)

What problem are they trying to solve

Last Mile transportation of a single person in an urban environment.Distances too short to wait for a Uber or Lyft and too far to bicycle.

Can this be a profitable business?

| Scooter Financial Model | Today | At Scale |

|---|---|---|

| Acquisition Cost (per scooter) | $415 | $375 |

| LifeTime Rides | 300 | 500 |

| Rides Per Day | 6 | 9 |

| Avg Ride Time Minutes | 15 | 16 |

| Ride Activation Cost | $1.00 | $1.00 |

| Ride Cost Per Minute | $0.15 | $0.15 |

| TOTAL Lifetime Revenue | $975 | $1,700 |

| Payment Processing | $24 | $41 |

| Lifetime charging cost | $375 | $333 |

| Lost/Stolen | $78 | $136 |

| Weather | $117 | $204 |

| Repairs | $143 | $111 |

| TOTAL Lifetime Costs | $736 | $825 |

| GROSS PROFIT | $239 | $874 |

| GROSS MARGIN | 25% | 51% |

PROS

- High Gross Margin

- Easy To Scale

- Low scooter capital cost

- Fits the gig economy model, minimal employees

- Trench: being included on Uber or Lyfts app

- Payback period: 12 to 22 days.CONS

- A NEW 25% tariff will impact

payback periods, profitability and ability to scale

- Low barriers to entry

- Scooters need frequent repairs

- Increased City regulations

- No feature differences

- Long Charging times of: 4 to 8 hours

- Limited Range: ~40 miles per charge, top speed ~15mph equates to a 160 minute runtime.

- 80% utilization (weather, battery health) yields 128 minutes of rider time;

- 6 rides of 15 minutes each is 90 minutes (56% utilization);

- 9 rides of 16 minutes each is 144 minutes (90% utilization).

- Customer Dissatisfaction: above 80% utilization runs the real risk of customer dissatisfaction with dead or low charge scooters. This would force companies to either recharge, swap batteries or take scooters offline during the work day, all expensive options

- Logistics: real time matching of supply w/demand will be the key to higher utilization of the scooters.

- Accidents & Injuries that can result in your insurance companies unwilling to pay. fully release, The scooter companies include language in their user agreements to be held harmless for injury, death, property damage and other losses.

| The Players | Funding | Valuation |

|---|---|---|

| Bird | $415M | $2B |

| Lime | $467M | $1B |

| Spin | $125M | |

| Skip | $6M | |

| CycleHop | ||

| Jump (Uber) | ||

| Lyft | ||

| Ofo | ||

| Razor | ||

| RideCell | ||

| Scoot | ||

| UScooter |

The Product

A fully assembled, customized scooter is inexpensive: $375 to $425.Vandalization, Hacking or Stolen

Theft, vandalization and hacking are all concerns but the companies seem to have those costs built into their profit models.Customers

There may be specific demographics who use scootersContract manufacturers build the scooters to spec for the scooter companiesImpact of Tariffs

A 25% tariff has been imposed on scooters imported from China. If it remains in effect over 6 months, the ride share companies will find ways to minimize the impact, ie assemble the scooters in the USA.Differentation

There does not seem to be any real differences between scooters from different companies.Pricing

Lime: $1 per use and .15 cents per minute

Spin: $1 per use and .15 cents per minuteTrips

Scootermaps.com estimates 240,000 trips taken per day (USA).Safety

Medical emergencies from falls, crashes are a part of using these scooters.The end game

Build a big war chest, Grow fast, get market share, sell out to multi-mode transportation companies.

Case Briefs

OPTICAL COMPONENTS

Full Company Restructure

Summary

VC backed private company was losing $2M cash/month. Products and technologies not aligned with customer needs.Approach

stop the cash bleed, lower the breakeven point, eliminate unprofitable products / customers.Results

Positive Cashflow, refocused product/ market fit, Merged company with lager multinational, ongoing enterprise.

TECH PRODUCTS

Contract Mfging / Product Mgt

Summary

Subcontractor, assembling medical device experienced 66% reject rate at final assembly and test. Thousands of non functional devices representing >$1.1M USD liability to the company, were stockpiled at the subcontractor.Approach

Evaluated product demand, cost, inventory, manufacturing capability and strategic product fit.Results

Shutdown manufacturing of the product, 2 years of inventory on hand, negotiated payoff of $250k USD vs $1.2M owed ($950k savings).

MEDICAL DEVICES

*Strategic: IP Ownership *

Summary

Company >$250k for previous design work.Approach

Verified consultant had satisfactorily completed the work (it was the core of currently shipping products)Results

Saved $152k, negotiated payment of $98k, and exclusive ownership of Intellectual property.

MEDICAL DEVICES

*Scale: Cashflow, Margins, Quality *

Summary

Components sourced around the world with final assembly at subcontractor in China. Company pays for each device shipped from the subcontractor but experiences a ~25% reject rate in the USA.Approach

Identified IP friendly country in existing supply chain, load encrypted final production program into devices before shipping to china.Results

Reduced final test fallout to zero a $2M/Yr cost savings,

SAAS

*Product Rollout *

coming soon

SummaryApproachResults

SEMICONDUCTOR COMPONENTS

Factory Divesture

Summary

Company wanted to close factory but it was sole source of IC components for strategic customers.Approach

Build bridge inventory, move equipment to new supplier, Qualify new factoryResults

Sold factory, sold IP, New factory qualified on time, no negative impact to customer.

TECH COMPANY

*Sell Excess Assets *

Summary

Company had scaled its infrastructure beyond revenue plan. Product mix had changed creating excess assets.Approach

Canceled undelivered equipment. Sold excess equipment.Results

Raised by selling equipment and IP $4.2M USD

Ace The Interview

Bill Mitchell

748Media.com exclusive network, preparing C-Suite Executives for their next job opportunity.

If you want to guarantee your interviews go well do the following:Research the company before the interview.Research each member of the executive team.Research the company’s culture.Role play or practice your questions and answers.Get a copy of the job requirements or request the job specification.Prepare a list of insightful questions to ask interviewers, by job function.Don't Speak negatively about your job or supervisor.Update your resume, bring an electronic copy with you, dropbox.Update your social profiles.Followup, collect contact info.

Technology Trends That Will Define 2018

Bill Mitchell

GarageSeeds.com micro-private equity operator applying fundamental business practices to leading edge business models to build sustainable companies.

ARTIFICIAL INTELLIGENCE (Ai)The Ai infrastructure has reached the point where reality supports the hype. Ai in 2018 will be defined by the fight for control of data. The more data a machine has and can process, the faster it learns. The country / companies who control the data will control Ai. Advances in computing power, the abundance of capital and the vast quantity of data being generated are allowing computers to learn, recognize and respond to trends faster than humans do.The United States currently leads the Ai race but China is aggressively moving to take the dominant position, and may surpass the USA in 2018, over the past half dozen years Chinese companies have tripled their patent submissions and are investing billions in Ai technology.Smartphones are the most widespread data collection devices. There are more smartphones in China than any other country. Chinese consumers are already generating tons of data when they swipe pay with their smartphones but voice interfaces are gaining traction. One area ripe for Ai is healthcare, maybe not robotics in the short term but Ai image recognition will help spot problems earlier and more reliably. is being used to spotChina has enacted data security laws that require foreign companies to store data collected on Chinese citizens within its borders. Self driving cars need high quality mapping data to operate reliably. China is also the largest new car market but it has blocked foreign companies from mapping its roads at a level of detail necessary to make self driving vehicles operate reliably; these restrictions do not apply to Chinese firms. These are examples of data protectionism. Western companies practice many of the same data protection techniques as Asian companies.The McKinsey Global Institute says Ai driven automation may boost China’s GDP by 1% annually.Ai is not without problems in one case researchers tricked self driving cars into misclassifying stop sign by applying paint or tape to the signs causing the vehicles to misclassify the signs.AUTOMATIONIn 1900 there were approximately 30 million farmers, in 1990 that number had fallen to 2.8 million. From a employment standpoint 27 million people lost their job. In reality new types of jobs were created to absorb those 27M people and more. The new wave of automation will have a different twist it will create new jobs in new fields, but probably not enough to offset the ones lost.What’s different this time around? When people migrated from farms to industry: There were help wanted listings in newspapers, family and friends to help guide the way, go to the city and within a couple weeks you had a job paying significantly more, with benefits, than what you made on the farm. Best of all they could use their same skills (muscle, long hours, middle to high school education), plus a little on the job training, so the learning curve was short.This time around the job path forward is not as clear, jobs are posted online, making them easier to see, but there is a skills mismatch between the jobs disappearing and the jobs being created. The new jobs require hundreds to thousands of hours of training to develop proficiencies that the existing workforce does not have.Customer Service, Healthcare, Logistics and Transportation are areas where Automation will accelerate. Machines have already made significant inroads in Assembly lines and Warehousing but other areas such as harvesting fruits and vegetables will see a major uptick in automation since the available labor pool becomes smaller. White collar jobs are already being infiltrated by automation, robots have been introduced into pharmacies and last year bots started writing articles indistinguishable from human authors. In law offices, to prepare discovery, clerks are being replaced by software.There are divergent opinions but over the next 10 years robots could replace nearly 30% of American jobs, with one researcher estimating up to 47% of the US jobs are at risk for automation.Generally jobs that can be defined step by step will become automated over the next few years; accountants, real estate agents, truck drivers, even bricklayers are some of the jobs in danger. Some of the jobs that will be lost are high paying.Foxconn recently announced a $10B Flat panel Display plant in Wisconsin.

The plant is to hire up to 13,000 workers at an average of $53,000 each per year. In reality if the plant is built it is more likely to employ fewer than 2,500 workers. Why? Automation. Seven years ago that plant may have hired 10,000 people but when this fully automated plant comes online it will need 75% fewer workers to produce the same output.Jobs that rely on creativity, empathy, interpersonal skill, and problem solving skills will not be automated for some time: designers, researchers, and some managers.Some industries will be hit harder than others as machines are becoming more intelligent and learn to do more each day.The more intelligent machines become, the more they can do for us. That means even more processes, decisions, functions and systems can be automated and carried out by algorithms or robots.20% of a typical workers time is spent performing well defined tasks in a stable environment, half of those activities will be automated by 2020. The service sector is most at risk for automation, especially food service where 80% of the activities are predictable. Automation in the food service sector will happen quickly. Example, one company is already working to drive robotic food delivery cost under $1 per delivery.If labor pool in a area is exceeds demand (skills, labor supply and the prevailing labor rate is low) a business may decide there is no business case to automate. In that case labor rates will slowly drift downward as the switching costs becomes cheaper.Service robots already serve as shopping assistants, they greet, answer questions and guide customers thru stores. They even help sell real estate. A wide range of industries and jobs will be impacted by the acceleration of automation into our economy.In the United States there are 19 robots for every 1,000 manufacturing workers, in South Korea there are 64 and in China around 7. Robot sales grew around 16% in 2017. This will continue to accelerate in 2018. Hundreds of new robot manufacturers are coming on line and a price war is likely. There will be a fallout and thinly capitalized companies will not be able to adjust to a “Robotics As A Service” RaaS, revenue model. This decreases the upfront capital cost of robot deployment and increases the number of qualified customers.Amazon started a mini arms race when it bought Kiva Systems back in 2012, companies are finally catching up. In 2018, 48% of warehouse fulfilment operations will use robotic systems.Robotics will not be limited to the industrial sector.A wide range of industries and jobs will be impacted by automation in 2018. The first wave machines are taking jobs that can be categorized using the four D’s: dull, dirty, dangerous and dexterity. Humans will no longer do the jobs that machines can do faster, safer, cheaper and more accurately.Dull: Performing the same task over and over again: put caps on bottles,Dirty: Handle toxic waste, navigate sewers, precision farming.Dangerous: Working where humans cannot: handle toxic waste, deep sea exploration, deep space exploration, car assembly, bomb retrievalDexterity: Robots perform precise tasks where a delicate, deft touch is needed: specialized surgeryBOTTOMLINE

Will Ai and Automation create more jobs than they displace?

The migration from a farm based society to an industrial one happened slowly, moving people from one type of unskilled job to another unskilled job. This switch is different, more compressed, both skilled and unskilled jobs are affected.If you look at a job and cannot immediately tell where a human adds value then that job will become automated.

Why Should I Hire You?

Bill Mitchell

748Media.com is an exclusive network of experienced C-Suite Executives actively and passively preparing for their next career opportunity. This article is written for senior executives but can be adapted to fit most job functions.

"Why Should I Hire You" is a common interview question it is usually asked during a fact to face interview, after a hiring manager has short-listed you. He / she has an interest and now wants to dig below the surface to see how good of a fit you are and if they like you.This is a question you need to NAIL as It gives you the opportunity to control your narrative by mapping your accomplishments, strengths, motivations and personality to the expectations of the interviewer.Remember to customize your delivery and show how the interviewer or his / her organization will benefit from you coming on board.Tell your story in a way that the interviewer can visualize you as the best fit.First, take a moment to mentally review any job requirements or specs you have knowledge of then quickly review your conversations to date.Be certain your social profiles and written documents are consistent with the story you tell.During the interview flush out concerns the interviewer may haveDo your homework, know the situation of the company, the industry, the environment.Is this the hiring manager? How much influence does this person have in the organization? What is his/her background? What is the culture of the company? What are they really looking for? It the business a success or has it fallen on difficult times. Remember fortunes can change overnight.A Hiring managers thinking is as follows::

Can I manage this person?

Can he/she perform the requirements of the job?

Will this person be excited about working here?

Will this hire make me look good?Your main focus will be to show how you will contribute to the company. Don't just list your past accomplishments, summarize the near term challenges of the job, the business environment, tell a few specifics about what you will do to get the company on track.

Tricky Interview Questions

Bill Mitchell

748Media.com is an exclusive network of experienced C-Suite Executives actively and passively preparing for their next career opportunity. This article is written for senior executives but can be adapted to fit most job functions.

You may be asked some or all of the following questions. Become familiar with them and develop answers you are comfortable with. Practice your delivery until it becomes natural.

What can you do for us that someone else can’t?Tell me about an accomplishment you are especially proud of.What have you not accomplished in your current job that you wish you had?Tell me about a time you made the wrong decision.What are your failures and what did you learn from them?What would you want to accomplish in your first 90 days in this job?It’s been a long time since you upgraded your education, how do you stay up to date on the latest trends?How would a former manager describe you?Tell me about a time you handled an angry or difficult customer.What are your salary requirements?What is your current salary?What salary do you think you deserve?Describe a time when you disagreed with your boss.What are your hobbies?Why were you promoted when others were not?Describe the first time you fired someone. The most recent time you fired someone.What should I know about you that I haven’t already asked?Describe your management style, your leadership style.Do you like sales?Describe an interesting problem and how you solved it.What excites you? Describe yourself.Tell me about a book you recently readWhat tools or systems do you need in order to be successful?What is your favorite movie of all time?How did you prepare for this interview?What on your resume is the closest thing to a lie?

Questions To Ask Interviewers

Bill Mitchell

748Media.com is an exclusive network of experienced C-Suite Executives actively and passively preparing for their next career opportunity. This article is written for senior executives but can be adapted to fit most job functions.

These questions are listed in no particular order and should be asked in the general flow of a conversation. Some of the questions are similar. Choose the ones you like and adjust them to your style of speech.

All Companies

What are your selection criteria?What skills are necessary to be great at this job?What are the immediate challenges of this position?What process will be used to evaluate my performance?Why is this position open? Where is the person who was previously in the position?What are the things I need to do to be successful?What issues or challenges about your job “the interviewers” keep you up at night?What’s your turnover rate?Can you describe the role of this position and the key success requirements?What’s your timeline for the next steps?What’s your timeframe for making the hiring decision?Describe the general culture of the company.May I contact you if I have additional questions? Note: Get contact info or business card.

Private Companies

How much cash do you have in the bank?Are your financials current? If not what is the most recent month you closed the books?Who are your investors?What is your monthly burn rate?Who are your top customers?Can I see a live demonstration of your product?Can I review your Cap Table?

Get Around Illegal Interview Questions

Bill Mitchell

748Media.com is an exclusive network of experienced C-Suite Executives actively and passively preparing for their next career opportunity. This article is written for senior executives but can be adapted to fit most job functions.

The object of an interview is to move toward a written job offer.

In my experience, the more senior the interviewer the less likely he/she is up to date on the latest interview techniques and the interviews themselves are informal than junior level interviews.Let’s say you are in the middle of a discussion and the interviewer asks a question you think is illegal, such as:

What country were you born?

How old are you?

What is your religion?

Do you have a disease that cause ….Don’t overreact, the stakes are high, many times the misstep is unintentional. Many senior executives were trained years ago. That is no excuse, its reality. If you get the job you can change the culture and implement training procedures and a structured hiring process. Another thought, this may be an intentional stress test to see how you react.One technique you might use: I’d be happy to answer your question but can you give me a little more insight how this question relates to the job, that way I can give you an answer that extinguishes any concern you may have.Or you might say, Is your company having an issue in this area that needs to be addressed, if so, could you give me your perspective of the problem?The more difficult illegal question is the one that’s in the interviewers mind and is never asked. Lets say you had a accident as a child that left you with a limp, you use a cane. The interviewer may wonder about your stamina or ability to travel. During your discussions hit those areas really hard, don’t leave any doubt about your stamina or travel ability.The key is to not make an interview combative, you must take control of the situation and steer the focus back to you, your accomplishments and your fit.There are many more techniques we can teach you.

Bitcoin: 2018 Update

Bill Mitchell

GarageSeeds.com micro-private equity operator combining fundamental business practices with leading edge business models to build sustainable companies.

It’s 2018 and Bitcoin’s price is fluctuating wildly. Members of the bitcoin foundation are fracturing, startups are shutting down, bitcoins are being stolen from wallets. I wrote this in 2014, some things have changed and some have remained the same.WHAT IS A BITCOINA Bitcoin is a type of virtual currency without all of the attributes of a traditional currency specifically you obtain them by mining or purchase them with traditional currency (issued by governments) or by trading goods or services for them.In early March 2014, the total market cap of the most widely circulated Cryptocurrencies was approximately $11B, by January 2018 the market cap for cryptocurrencies is $700B and projected to reach $2 Trillion by the end of 2018. Bitcoins represented about $200B of the current market cap for cryptocurrencies.One survey, by Lendedu, say 79% of Americans have heard of bitcoin.BUMPS IN THE BITCOIN ROAD OR LONG TERM DECLINEBitcoin had a great 2017, starting the year around $800 and peaking at $20,000 in December but it recently crashed to $11,500 (January 2018) all coins are down, it’s not just bitcoin.Longer term the biggest problem seems to be political, as several countries seek to control or outlaw cryptocurrencies. China, South Korea and Russia are all contemplating crackdowns on cryptocurrency exchanges, services and trading. Almost 60% of bitcoin mining is in China.PRICING HISTORYThe bitcoin network came into existence Jan 03, 2009 created by Satoshi Nakamoto, whose real identity is unknown. A bitcoin was originally worth less than a cent, by March 2013 they were trading at $30/each, a month later they peaked at $260 and today they are worth in 2014 they were $122/each and now they are worth $11,500/each; There are currently approximately 16.8 million bitcoins in circulation that number will increase each year until the year 2140 when the upper limit of 21 million bitcoins will be in circulation.IS BITCOIN A GOOD CONSUMER CURRENCYBitcoin transactions are typically referred to as anonymous. While it may be possible to obscure your identity in many cases you can be identified.Few merchants currently accept bitcoin. The Dallas Mavericks NBA team recently announced they will accept bitcoin next year but Stripe is cancelling its support of bitcoin.Bitcoin transactions are slow, Visa can process 24,000 transactions per second; Paypal 193, bitcoin 7. it can take 10 to 20 minutes for blockchain to confirm a transaction; but companies are working to speedup the network and decrease transaction time.Wide price swings make it difficult to use for payment.Bitcoin wallets can be complicated to use.Bitcoin transaction fees, for sending bitcoin, can be as high as $37.Of note, approximately 2.8 million to 3.8 million bitcoins have been lost forever. When you lose a bitcoin it is usually not recoverable.As it stands today, it’s a difficult currency to use in the real world.RISKBitcoin has five major downsides:(1) volatility, the value of a bitcoin is not static;(2) security, there have been several documented cases of Fraud and theft, Some bitcoin exchanges have been hacked and some have shutdown without refunding customers money; a successful hack of the blockchain (the technology that records and verifies every transaction) would be a potentially fatal problem.(3) competition Ripple, a competitor is trying to gain traction. Venture capital is pouring into bitcoin companies. Adam Draper who runs Boost, a startup accelerator is looking for 7 bitcoin companies;(4) public policy, while virtual currency is legal in the United States, it has not been given a governmental seal of approval. Regulatory roadblocks, not demand may be the biggest hurdle keeping bitcoin from going mainstream. Several countries are cracking down on cryptocurrency, among them are South Korea,(5) the network is slow and difficult to use and who wants to spend bitcoin today when its value may double next week.GETTING STARTEDTo get started you need a software wallet, there are dozens of options. Your wallet contains two sets of keys: Your private key keeps track of your bitcoin(s). Your public key allows you to transact with the outside world. Note: if you lose your private key, or its hacked, your bitcoin(s) most likely cannot be retrieved. To get bitcoins you either sell something and receive bitcoin in return, purchase or mine them.INITIAL COIN OFFERINGS / ICOInitial coin offerings “ICOs” are one of the newest ways for companies to raise money, in fact they raised over $3.6B selling digital tokens in 2017.In 2017, ICOs raised over $3.6B in digital tokens, reflecting a faster pace than that of any other early-stage venture capital funding source.Here’s how an ICO works, a new cryptocurrency is created on a protocol such as Ethereum,

a value is arbitrarily assigned by the startup based on what they think the network is currently worth. The ultimate pricing is arrived at by network participantsSUMMARYCurrently the people who are most bullish are the early bitcoin owners who are "in the money" they are essentially betting bitcoin values will increase.For the next couple of years bitcoin may be a victim of its own success, the huge price swings caused by speculation may get worse. The newness is wearing off only 14% of Americans own bitcoin. The bitcoin ecosystem will is growing improving and stabilizing.2018 is shaping up to be a wild ride for bitcoin investors.

Startup: Terms, Preferences & Control

Bill Mitchell

GarageSeeds.com a micro-private equity operator combining fundamental business practices with leading edge business models to build sustainable companies.

Use Caution When Feeding A UnicornUnicorns, companies with billion dollar valuations while still rare are being created at a faster pace. Startup founders who own stock worth over a billion dollars is rarer. The reason may be a function of how unicorn companies are funded.Unicorns are hatched when a team with an idea (product, service or app), that hundreds ofmillions or billions of people might potentially use, participates in a seed incubator. The incubator places a non-negotiable investment (amount, valuation, terms, preferences) in the new company. At this point the company usually has no or minimal revenue. The company gains traction; strong user growth and stickiness validate the product/ market fit.Within 3 years the founders have convinced multiple investors to place hundreds of millions of dollars, spread over multiple funding rounds, into the company. The stock price, which was originally pennies per share usually rises 2X or more with each new round of funding.Private investor money is not free, down the road, they expect an exit event (IPO, Merger) that will pay them many multiples of their original investment.Valuations on startups that are well above those of more established companies (sometimes even Venture capital investors placein the same space) and typically years before the startup develops a reliable revenue stream or GAAP positive earnings. There are expectations, by all, that the company will grow into and surpass these aggressive valuations.One would think given the multi-billion dollar startup valuations newly minted billionaire founders would be created at an increasing frequency. That is not as easy to accomplish as it might seem. The primary reason is dilution, each funding round decreases the founders ownership of the company. The other reason which doesn't get as much attention are the debt and equity investments terms and preferences. Depending on how well the company performs, these can have a substantial impact on the founders net worth.

10X return with no riskIn most unicorn situations investors own a majority of the company. Beginning with their initial investment, they look for ways to reduce their downside exposure: loans, convertible notes, preferred stock all serve to put the investor(s) in position to be paid ahead of founders / common stock holders if the company doesn't grow as planned. Venture capitalist invest money raised from limited partners. They are placing large amounts of money into the hands of companies with little revenue and no profits.Most founding teams are not expert term sheet negotiators while most investors are expert term sheet negotiators this is their core job. Founders tend to be optimistic and only see upside potential. That's partially why they start companies. They may not fully comprehend the impact of the funding documents they sign especially in a less than optimum exit or down round situation.Investors in early stage ventures tend to be risk adverse even though by definition investing in a startup is risky. Starting with the term sheet, investment documents set the boundaries for how much money each party will receive in various exit scenarios.

While initial funding may have come from an Angel or VC investor as the capital needs become larger, hedge funds, mutual funds and other sophisticated investors will likely participate. We tend to think of investors acting as a tight knit group but their interests may be divergent. It depends when and under what terms they invested.For example, a cap table (Accounting Ownership) may show the founders own 30% of the

company stock, however, if they have raised several rounds of funding with convertible notes, common stock, preferred stock, and debt, the founders payout (Economic Ownership) may be significantly less, even $0, it depends on the sales price and terms negotiated in each funding round.Before signing a term sheet create a cap table waterfall. It should show all prior funding (debt and equity) and the current contemplated funding. Pick a range of Low, Medium and High exit values. The Low scenario should be low enough no one is happy; the Medium scenario should show some happiness; the High scenario should show everyone thrilled.

Calculate the payout EACH preferred stockholder, each debt holder and each common stockholder would receive in each of the 3 scenarios. Remember preferred stockholders and debt holders are paid before common stock holders.Don't be surprised if your economic ownership is smaller than the accounting ownership

indicates.Bottomline: It's critical that the CEO/Founders ensure the core and extended team have enough Economic Ownership to be sufficiently motivated.

Tesla Powerwall Economics 2015

Bill Mitchell

GarageSeeds.com a micro-private equity operator combining fundamental business practices with leading edge business models to build sustainable companies.

NOTE: We will update this in 2018 as the economics of the Tesla Powerwall seems to have changed.Tesla wants to disrupt the way our homes are powered but are their batteries economical for households use? PowerWall batteries have capacities of 7 and 10 kilowatt-hour (kWh) and cost between $6,000 and $7000 USD including installation. They are able to discharge continually at 2 kWh for 3.5 to 5.0 hours.Assuming no other forms of power were available, a home that consumes 6 kWh at peak would need to purchase 3 units or reduce its energy consumption to extend battery life at a cost between $18,000 and $21,000.The homeowner must decide the intended use for the batteries:1. Provide power in an emergency outage.

a. If the power outage lasts fewer than 5 hours the PowerWall can

deliver enough energy.

b. If the outage lasts over 6 hours the homeowner will need to cut

energy consumption to have power available thru the night.2. Provide power routinely when solar or wind power not available.

a. Assuming 12 hours per day without solar/wind power (6pm-6am),

i. the homeowner will need to cut electrical consumption by 50-60% when using the batteries.

ii. or purchase an additional PowerWall ($7k) ($28k total)Another option is to spend ~$4,000 to purchase a 16 kWh gas powered generator.The annual capacity cost of PowerWall batteries is $0.3 per kWh, in the USA only Hawaii has an average electrical rate ($0.37 kWh) that makes the PowerWall economical.European electrical rates average $0.35 kWh, it makes sense to install PowerWalls there.

Cryptocurrency: Whats Driving the Boom

Bill Mitchell

GarageSeeds.com a micro-private equity operator combining fundamental business practices with leading edge business models to build sustainable companies.

As of early March 2014, the total market cap of the most widely circulated Cryptocurrencies is approximately $11 billion USD; bitcoin represents about $8.2 billion of that.Monday March 3rd, bitcoin startup, Flexcoin who billed itself as the first bitcoin bank,

announced it was shutting down following the theft of almost 900 bitcoins worth over

$600,000 USD. This comes on the heels of Mt. Grox losing ~850,000 bitcoins worth

~$500MM USD and filing for bankruptcy protection.These problems will not in themselves stop bitcoin but do the portend a deeper

problem? On one hand hackers seem to be relentless on the other hand we can look at

payment giant Paypal (not a bitcoin company) has been able to keep the hackers at bay.The knee jerk reaction would have government regulate and oversee cryptocurrencies.

Janet Yellen chair of the Federal Reserve has already told congress bitcoins are outside

the banking system and therefore cannot be regulated. "There is no central issurer or

network operator to regulate".Bitcoins and other cryptocurrencies act as worldwide currencies without regulation. That

is good and bad. Good because weak companies and flawed practices will be exposed.

Bad because this will cause short term pain, people will lose money because of unanticipated risks.There is little recourse if someone steals your bitcoins. These are not the 1st bitcoin companies to suffer losses and will probably not be the last. These problems seem to be with the lack of controls at the affected companies and not problems with the bitcoin protocol.THE PAST

Bitcoin surpassed Paypal in daily transaction volume $416M vs $397M.Back in October, the FBI shutdown Silk Road (a website on the Tor network) the

underground marketplace where users could buy cocaine, heroin, meth, and more

using the virtual currency Bitcoin. They also siezed 26,000 Bitcoins worth about $3.2

million dollars. The value of all Bitcoins immediately dropped by ~20%.Here is a link to an article describing the alleged illegal activities at

The shutdown of Silk Road illustrates some of the inherent instability and price swings

of Bitcoins. Shutting down Silk Road is a good thing for Bitcoins investors, it paves the way for more Bitcoins to be viewed as a mainstream medium for conducting transactions.History

The bitcoin network came into existence Jan 03, 2009 created by Satoshi Nakamoto,

whose real identity is unknown. A bitcoin was originally worth less than a cent, by March

2013 they were trading at $30/each, a month later they peaked at $260 and today they

are worth $122/each; There are currently approximately 11.2 million bitcoins in

circulation that number will increase each year until the year 2140 when the upper limit

of 21 million bitcoins will be in circulation.Bitcoin transactions are typically referred to as anonymous. While it may be possible to

obscure your identity in many cases you can be identified. Few merchants currently

accept bitcoin. The real opportunity starts when there is mass adoption of bitcoin by

merchants looking to escape high ATM/credit card transaction fees. Currently the

people who are most bullish are the early bitcoin owners who are "in the money" they

are essentially betting bitcoin values will increase. More people are using the currency,

in April, a record, $1 billion in bitcoin changed hands.Bitcoin has four major downsides: (1) volatility, the value of a bitcoin is not static; (2)

security, there have been several documented cases of Fraud and theft, Some bitcoin

exchanges have been hacked and some have shutdown without refunding customers

money; (3) competition Ripple, a competitor is trying to gain traction. Venture capital is

pouring into bitcoin companies. Adam Draper who runs Boost, a startup accelerator is

looking for 7 bitcoin companies; (4) public policy, while virtual currency is legal in the United States, it has not been given a governmental seal of approval. Regulatory

roadblocks, not demand may be the biggest hurdle keeping bitcoin from going mainstream.Getting Started

To get started you need a software wallet, there are dozens of options. Your wallet contains two sets of keys: Your private key keeps track of your bitcoin(s). Your public

key allows you to transact with the outside world. Note: if you lose your private key, or

its hacked, your bitcoin(s) most likely cannot be retrieved. To get bitcoins you either sell

something and receive bitcoin in return, purchase or mine them.Investors

High profile venture capitalists such as Andreessen Horowitz and Union Square

Ventures have invested in virtual currency related companies. Established players such

as Google and PayPal have taken notice of bitcoin. Google is supporting Opencoin.

PayPal is teaming with OANDA.Summary

For the next couple of year’s bitcoin may be a victim of its own success, the huge price

swings caused by speculation may get worse. Once the newness wears off the currency

may reach its potential but significant obstacles remain: government policy, security

and competition but the bitcoin ecosystem will grow and improve and eventually

stabilize the bitcoin.

Linkedin For Senior Executives

Bill Mitchell

748Media.com is an exclusive network of experienced C-Suite Executives actively and passively preparing for their next career opportunity. This article is written for senior executives but can be adapted to fit most job functions.

Where does Linkedin fit in the senior executive’s online presence? Is it your Resume? your network? Your branding tool? It can be these things and more. How you position your profile depends on a variety of factors, is your search low profile? Confidential, One thing is certain, your profile is not a stand alone tool, it needs support, it is not a resume.Update your profile at least once per year or more often if appropriate.:Header

Include your job title and a short high level overview of your experience. It should talk to your target audience.Use Your Real NamePhotograph

Upload a recent business quality headshot photo. Strongly consider using a professional studio photographer. Profiles without photos are usually ignored by recruiters and hiring managers.Summary

Show your value, dollarize, use numbers, hiring managers and recruiters zero in on this section; it should be keyword rich but informative and to the point. Ideally your summary should be 3-5 short paragraphs, preferably with bullets. Write in the 1st person.Experience

Include companies you worked for, when and in what capacity. Tell results achieved. Show current skills not dated skills.Education

List the educational institutions you attended even if you did not graduate. Be clear about degrees earned. Be careful with dates, it is not necessary to indicate when you received degrees, that can indicate your age in some instances.Interests, Volunteer Experiences or Languages

Showcase uniques experiences that set you apart from the crowd.Personalize Your Linkedin URL

It makes you look more professional, more memorable.Become an Author

Write, publish your work on Linkedin, share your unique perspective of recent industry developments.How to connect with me on LinkedinSend me a personal note that gives me a reason to connect with you. If I don’t know you and you don’t take the time to write a note, I won’t connect with you.Do business with me, I like connecting with people I know.Get referred by someone I know and trust.Connect With Bill on Linkedin

Template

Title

Bill Mitchell

GarageSeeds.com a micro-private equity operator combining fundamental business practices with leading edge business models to build sustainable companies.

748Media.com is an exclusive network of experienced C-Suite Executives actively and passively preparing for their next career opportunity. This article is written for senior executives but can be adapted to fit most job functions.

Body Text - Body Text

Contact

C-Suite Executive

Fixing: Startups, Emerging Growth & Turnaround Companies.

Email Me

Scottsdale, Arizona USA

MEGATRENDS: 2019

Data Science Feed

Machine Learning

Executive Guide To Machine LearningEducation

Certificate In Data Visualization

Best And Worst Graduate Degrees For Jobs

What Does It Take to be a Data Scientist or Analyst

Startup Institute Is Launching a Data Science CourseGeneral

What Data Scientists Really Do,

According to 35 Data ScientistHow Analytics Can Be Misused

Data Mining, Visualization and InfographicsTools

Bouquet - The Open-Source Analytics Toolbox

Data Visualization Catalogue

10 Free Data Visualization Tools

38 best tools for data visualization

31 Free Data Visualization Tools

AI / Robotics Feed

Machine Learning

Executive guide to machine learningWorkforce Trends

2017 In Review 10 Ai Failures

In 30 Years robots will be half of the workforce

The Long-Term Jobs Killer Is Not China. It’s Automation

CleanTech / Environment

Air, Water, Wind

Solar, Energy Storage

Pollution

Solar

Is the Tesla Roof Worth the CostEnergy Storage

New plants show lithium-ion storage ready to power grid.

Powerwall Lets Homes Run Entirely On Solar Energy

Samsung EV battery gets 300+ miles from a 20-minute charge.

CrowdFunding Feed

Equity Crowdfunding

Regulation Crowdfunding

Revised Rule 504

Rule 504 of Reg D: Small Entity Compliance Guide for Issuers

SEC Regulation CrowdFunding

BlockChain/Crypto/ICO Feed

Bitcoin / Crypto Currency

How Bitcoin Actually Works

Bitcoin Is Eating Itself

How To Buy Bitcoin Anywhere in the worldBlockChain

How Blockchain is overshadowing Bitcoin

Blockchain A-Z: Everything You Need to Know

The Truth About Blockchain

Blockchains: How They WorkICO

Guide to launching a Initial Coin Offering ICO

ICO 101: How To Do A Initial Coin Offering Right

EdTech Feed

Coding Classes

Want a Silicon Valley job? Keep Away From Coding Schools

You might not need that $15K coding bootcamp

We asked 15,000 people how they learned to code

Startups Feed

FundRaising

Multi Round Fundraising StrategyDown Round

Confronting A Down RoundSeed Financing

Convertible Seed Notes83b Election

What Is An 83(b) Election and When Do I Make It?

What Is An 83(b) Election And When Shouldn’t I Make It?409a Valuation

409A Considerations for Startups

What Every Founder Needs to Know About 409A Valuations

eShares: 409a Valuation as a ServiceCap Table

Broken Cap Tables

eShares Paperless Stock Certificates & Cap TrackingFinance

The Tricky Business Of Balancing Early Startup Finances

What I Learned About Venture Funding

Make Your Financial Model Stand Out to Investors

SeriesSeed Documents

YCombinator Safe Financing DocumentGeneral

Keep these documents up to date.Legal

Orrick - Startup Legal Forms

Clerky Legal Concepts Handbook

UpCounsel free legal documents

Startup Lawyer Legal Docs For Tech Startups

Key Legal Docs for BusinessOption Pool

Option Pool size in early stage company

Option Pool Shuffle

Negotiating The Option PoolKeeping Score

Run Your Company Based on MetricsStock

What I Wish I'd Known About Equity Before Joining A Unicorn

Questions to Ask Before Accepting Startup Stock Options

How startup options work

Stock Plan Used by YC CompaniesStock Options

Stock Options: Nonqualified vs. IncentiveTerm Sheet

Founder Friendly Term SheetTrademark

Low Cost Trademark ProtectionValuation

Liquidation Preferences

Term Sheet Liquidation PreferencesSecurity

What Security will VCs WantRegistration Rights

What are Registration Rights

Medical Tech Feed

US Economy Feed

US Economy

US clean energy funding gutted, 13M high paying jobs to China.

Transportation Feed

Autonomous Vehicles, Scooters,

Electric Vehicles, Bikes

Electric ScootersBird Scooter EconomicsWhat Drives Value at Scooter StartupsAre scooter startups really worth billions

Gig Economy

Gig Workforce

Six-Figure Earners, a Growing Share of the Gig Workforce

INFOGRAPHIC

RESUME

Privacy Statement

We do not share your personal info with anyone without your consent.We use a minimal number of analytics trackers to determine web site performance. Currently we use stat counter and google analytics. Over time we may change to others, if we do we will update this privacy statement.